In April 2022, just after the Out Of Africa NFT Collection was auctioned on OpenSea, the founder and CEO of Invictus Capital, Daniel Schwartzkopff was forced to tender his resignation during an Invictus board meeting. Invictus Capital is a regulated asset manager and crypto fund provider, and the Invictus NFT Lab a blockchain-based platform to help artists create and sell NFTs.

TERRA LUNA’s (UST) COLLAPSE

The Terra ecosystem was thrown into chaos when UST de-pegged sharply from the price of one US dollar, putting Anchor Protocol under major pressure. Terra’s Anchor Protocol had offered yields of up to 20% to depositors of TerraUSD (UST), the Terra-native algorithmic stablecoin. Crypto lending business Celsius had at least half a billion dollars of funds parked in Anchor Protocol but allegedly pulled all of it out over a frantic 24 hour period following the de-peg. Celsius allowed retail investors to earn interest on their crypto holdings, advertising interest rates of up to 17%. According to its website at the time, the company served 1.7 million customers. Early on May 11, with Terra’s tokens in freefall, Celsius withdrew some 225,000 ETH (or $463 million) from Anchor Protocol, according to The Block Research’s analysis.

As all of the above was in the process of unfolding, an Invictus Fund Analyst told investors “we don’t see much of a risk of the peg breaking down,” citing the past performance of UST as the basis for his rationale. He further stated that he had “full confidence that the peg will be maintained.” The Invictus Analyst later added that “we’re earning pretty amazing interest… 30+%,” and he was “still not worried.” He additionally declared that he didn’t think it was a possibility that LUNA could go to zero “and stay there.” Even after UST had fallen below $0.65, Invictus remained bullish, and maintained its UST position. The following day (May 12), Invictus investors received an email informing them that over $22.5 million of UST was held across several funds.

Two of the core products offered by Invictus were crypto index funds called C20 and C10. C20 was marketed as a way to invest in “regulated and tokenized funds” and allowed investors exposure to “the top 20 crypto assets” through one single token. Meanwhile, C10 was a hedged “smart index fund” designed to limit the loss of capital using a “dynamic cash hedging mechanism.” The crypto within the C20 Fund was supposed to be held in cold storage, according to the portfolio’s whitepaper. However, Invictus later revealed that 50% of the C20 fund and the majority of C10 were, instead, held on Celsius.

The next email to investors confirmed the exposure to Celsius but interestingly contradicted an early statement regarding the C10 exposure to UST. The total value of reserves held in Celsius was estimated to be in the region of $49 million before the collapse of Terra and $23 million after. The funds were approximately 55% of the total assets under management.

The Celsius Network went bankrupt in July 2022. At the time of Celsius’ bankruptcy filing, in which Invictus Capital was listed as one of the largest creditors, the value of assets amounted to $17.7 million. Invictus Capital and parent company New World Holding (NWH) both filed for voluntary liquidation.

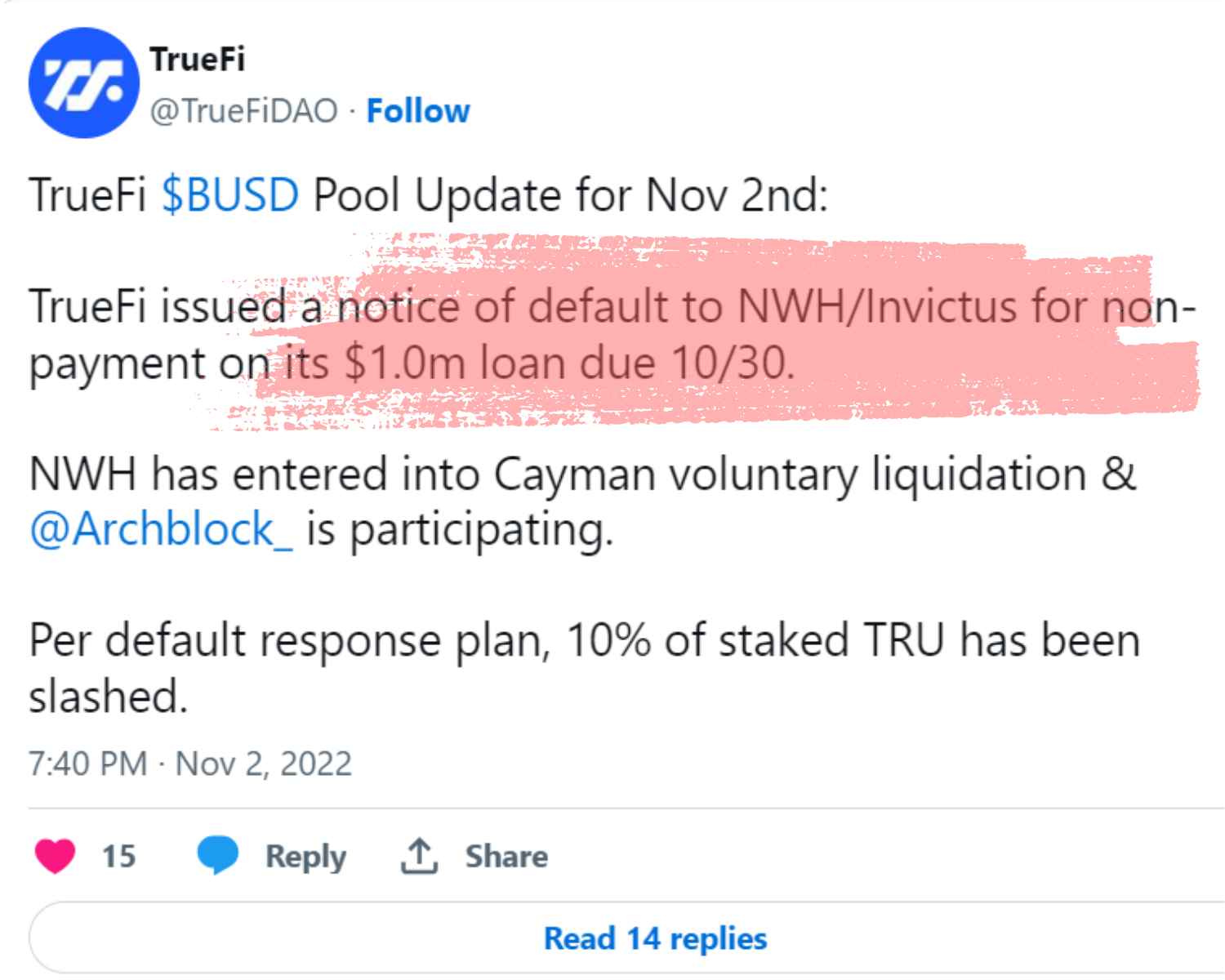

DEFAULT ON TRUEFI LOAN REPAYMENT

Invictus Capital defaulted in making a loan repayment due on October 30 2022. The debt was uncollateralized, meaning Invictus didn’t pledge any asset against the loan. It secured the loan with its good reputation and financial strength at the time. Invictus Capital borrowed $28.8 million and paid back the loan with interest through 2020 and 2021 before it failed in the recent loans.

“Invictus’ default once again illustrates the fragility of trust-based uncollateralized lending.”

FundStrat Vice President, Walter Teng

The liquidation of Invictus Capital and New World Holding (NWH) is likely to have a significant impact on the Invictus NFT Lab “Out of Africa NFT Collection” contract. The contract is likely to be terminated, and investors in the collection are likely to lose their money. There has been no comments or statements from Invictus Capital’s CEO Haydn Hammond or ex-CEO Daniel Schwartzkopff who continues to work at Data Prophet.

Sourced courtesy Ryan Weeks https://www.theblock.co/post/146752/celsius-pulled-half-a-billion-dollars-out-of-anchor-protocol-amid-terra-chaos