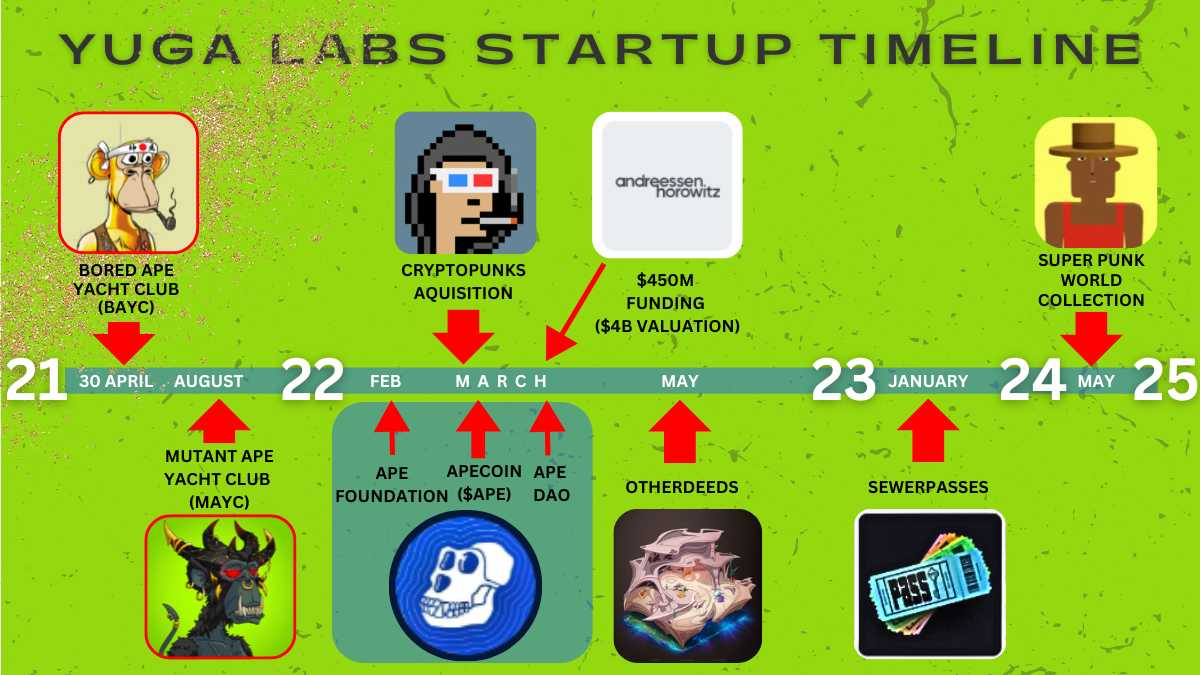

Yuga Labs, founded in 2021, has become a reference point in the CRYPTOART NFT profile picture (PFP) collectibles landscape, thanks to the start-up success of their Bored Ape Yacht Club (BAYC) collection.

In late March 2022, off the back of their BAYC-MAYC success, Yuga Labs secured a $450 million seed funding round from Andreessen Horowitz (a16z), valuing the company at $4 billion. Animoca Brands, a game studio and subsidiary of Sandbox, participated in the funding round and partnered with Yuga Labs to develop games and entertainment experiences. LionTree, Sound Ventures, Thrive Capital, FTX and MoonPay also participated in the seed funding round, partnering with Yuga Labs to support its growth and expansion.

At the end of 2023, Yuga Labs had a value of $8.1 billion.

They managed to turn 10,000 utility-less monkey JPEGs into a multi-billion-dollar empire in less than two years.

Mete Gultekin, Vader Research

Yuga Labs and their Yuga Ecosystem is a start-up success story. Is this a USA-specific once-off, or is Yuga’s success based on sustainable web3 foundations that can inform start-ups in other parts of the globe? Let’s look at their business model.

Identifying with the BAYC Culture

“We want your Bored Ape to be your digital identity,” Gargamel, one of the founders, told me during a recent video chat. It’s a collectible not to hang on the wall or exhibit on a shelf but to populate the tiny square or circle of screen space that’s supposed to represent your self.

Conversation with BAYC founders, New Yorker, Kyle Chayka, July 30, 2021

The image of an online dive bar stuck with the pair, though, and from there a science-fictional story line took shape. The year is 2031. The people who invested in the early days of cryptocurrency have all become billionaires. “Now they’re just fucking bored. What do you do now that you’re wealthy beyond your wildest dreams?” Goner said. “You’re going to hang out in a swamp club with a bunch of apes and get weird.” Why apes? In crypto parlance, buying into a new currency or N.F.T. with abandon, risking a significant amount of money, is called “aping in.” “We also just like apes,” Goner told me.

Conversation with BAYC founders, New Yorker, Kyle Chayka, July 30, 2021

Wylie Aronow aka Gordon Goner, is one of the four founders of Yuga Labs. Goner, former creative director and visual artist in the advertising industry, had a very clear image of the BAYC identity and who would be part of their community (Club) – hyper-masculine, Hemingwayesque type crypto-bros.

Revenue Channels

Yuga Labs generates revenue by selling unique digital collectibles (NFTs), such as the Bored Ape Yacht Club (BAYC) and Mutant Ape Yacht Club (MAYC) as well as selling tokens (ApeCoin) primarily on the Ethereum blockchain. Yuga Labs earns royalties on secondary sales, where buyers and sellers trade BAYC and other NFTs on Web3 marketplace platforms like Blur and OpenSea. Yuga Labs levies a 2.5% royalties charge on secondary sales for BAYC and MAYC, while they charge 5% for OtherDeeds and SewerPasses.

The company partners with brands, artists, and other organizations to create exclusive content, merchandise, and experiences, generating revenue through licensing fees and royalties.

Yuga Labs’ ApeCoin, is a cryptocurrency ($APE) used within the APE ecosystem. ApeCoin (together with the APE DAO) facilitate decentralized governance, allowing holders to vote on decisions related to the APE ecosystem. It also serves as a utility token for various services and products within the APE ecosystem, such as purchasing NFTs or participating in exclusive events.

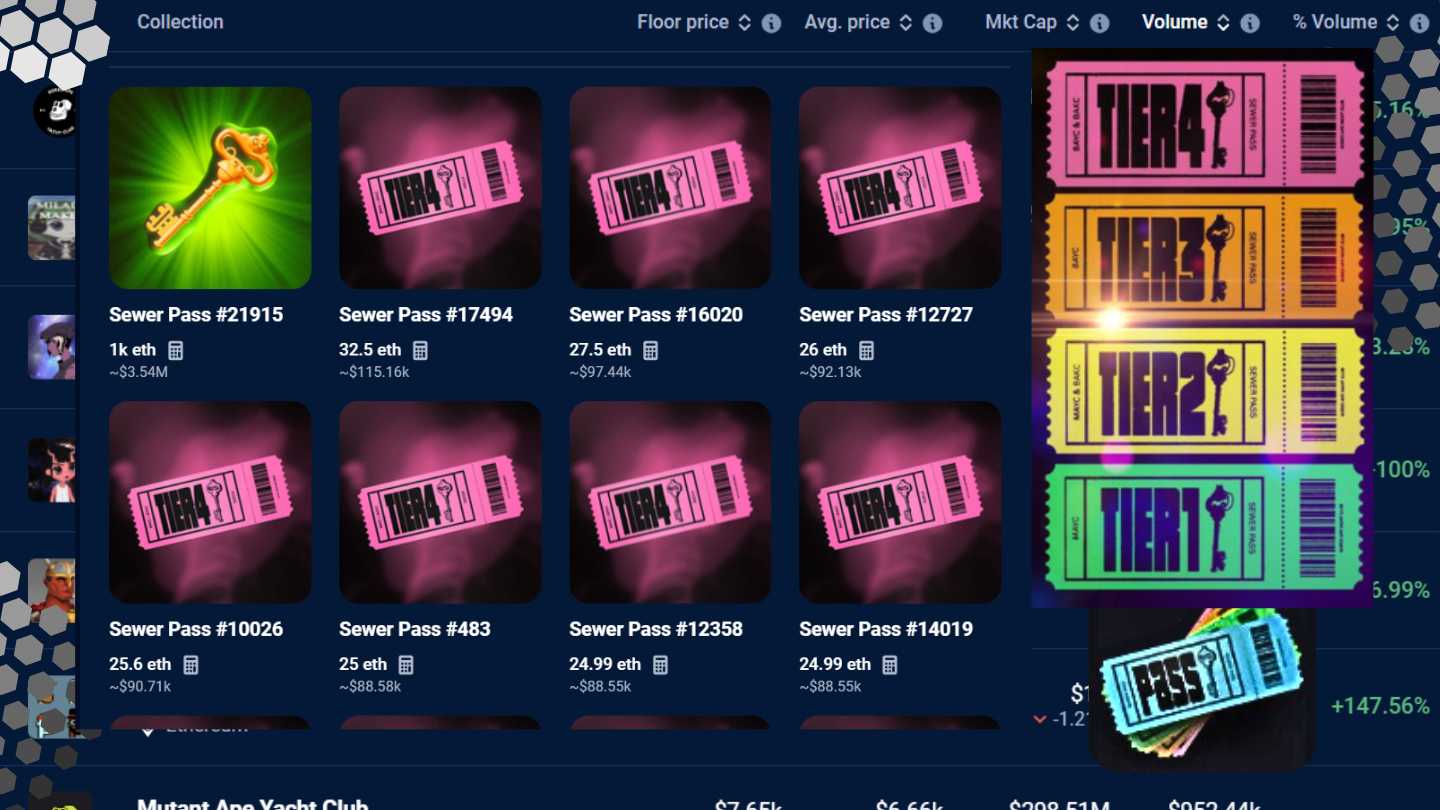

The SewerPass is a NFT giving access to Yuga’s hyper casual mobile game called Dookey Dash.

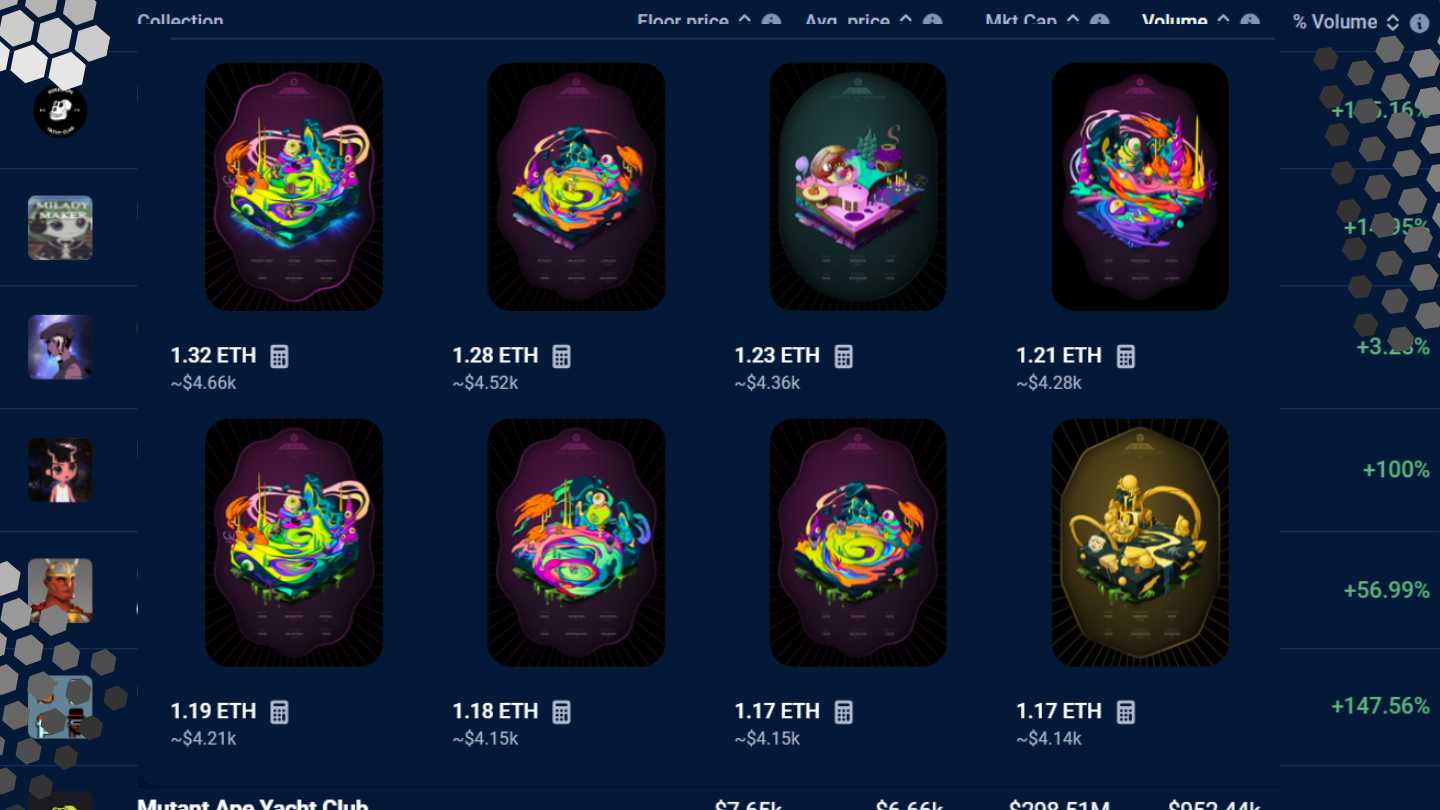

Yuga Labs’ OtherDeeds represent ownership of virtual plots of land within the Otherside Metaverse, a decentralized virtual world. These plots of land can be used to build and develop virtual structures, experiences, and content within the Otherside Metaverse.

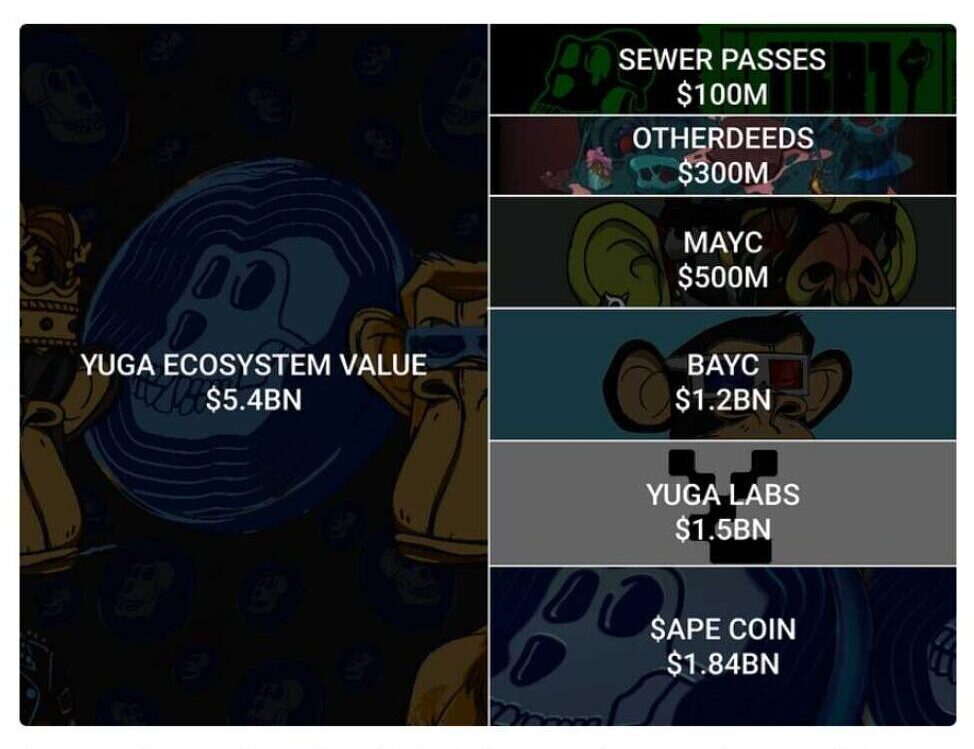

The Big Picture Yuga Ecosystem as at March 2023

The Yuga Ecosystem value is equal to the sum of money belonging to the Yuga Labs Equity entity (VC + Founders) plus the value of all existing NFT collections (BAYC, MAYC etc.) and tokens ($APE). The NFT collection market cap is calculated based on the floor price multiplied by the circulating supply.

Based on the $450M seed round, it appears that Yuga Labs Founders own 89% of the company, while Yuga Labs VCs own the remaining 11% (Vader Research).

Yuga Ecosystem Value = Yuga Labs Equity Value + Value of Yuga NFTs & Tokens

Let’s go back to the beginning, the BAYC launch in April 2021 and move through the Yuga Labs start-up timeline.

The Bored Ape Yacht Club (BAYC) NFT Collection, Launch End April 2021

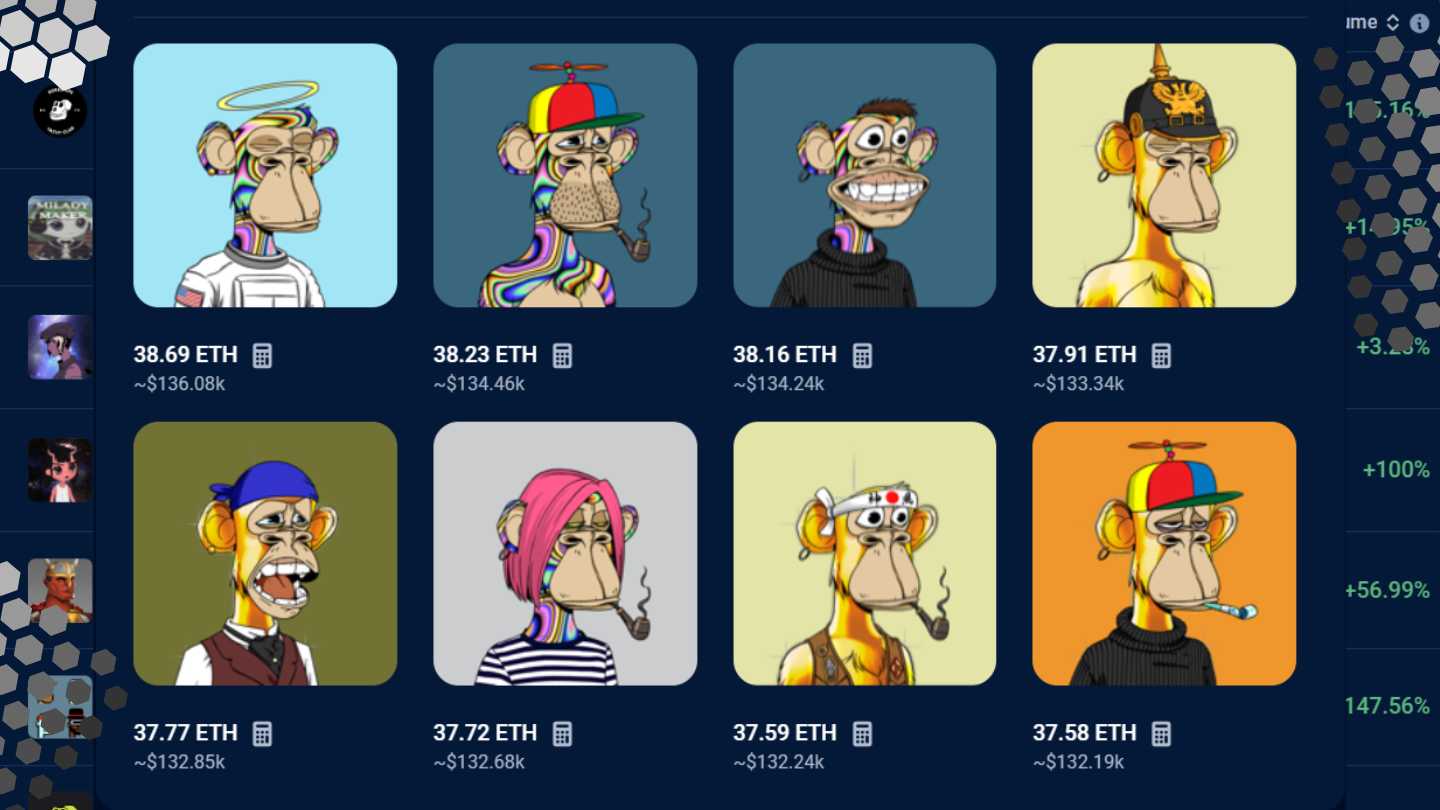

The BAYC collection (10,000 unique NFTs) launched on Friday 30th April 2021, with each ape selling for 0.08 ETH (approximately $230) during the initial mint. BAYC price rose from $200 to $66K in 4 months and generated $2.5M in BAYC royalties from secondary sales.

The floor price for a BAYC mid June 2024 was around $40,670. The BAYC’s value is heavily influenced by the broader cryptocurrency market (bulls and bears), the NFT market, as well as the Yuga ecosystem’s overall health and popularity. The community’s anticipation of new projects, such as the MAYC, ApeCoin and OtherDeeds, also impacts the value of BAYC NFTs.

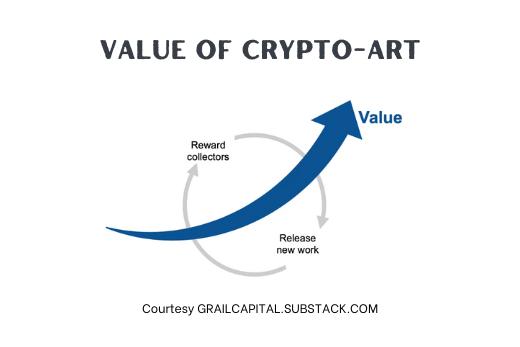

The Value Accrual Business Model

The BAYC NFTs are personal avatars or profile pictures (PFP) categorised as digital collectibles. NFT ownership explicitly gives access to a gated online community, exclusive in-person events, commercial rights to the image owned, as well as implicitly giving a stake of the Yuga Ecosystem.

Yuga Labs created a new group of stakeholders known as BAYC Holders when they issued and sold 10K BAYC at $200* per item, earning $2M from the primary sale. It’s important to note that NFTs sold by PFP projects and web3 game studios aren’t just virtual goods, people buy them with the expectation that their value will increase over time. This is why BAYC owners are considered a separate stakeholder class in the Yuga Ecosystem, as the issuer company has a responsibility to these NFT owners.

Vader Research, Value Accrual Case Study: Yuga Labs, Mar 8, 2023

Mutant Ape Yacht Club (MAYC) NFT Collection, Launch August 2021

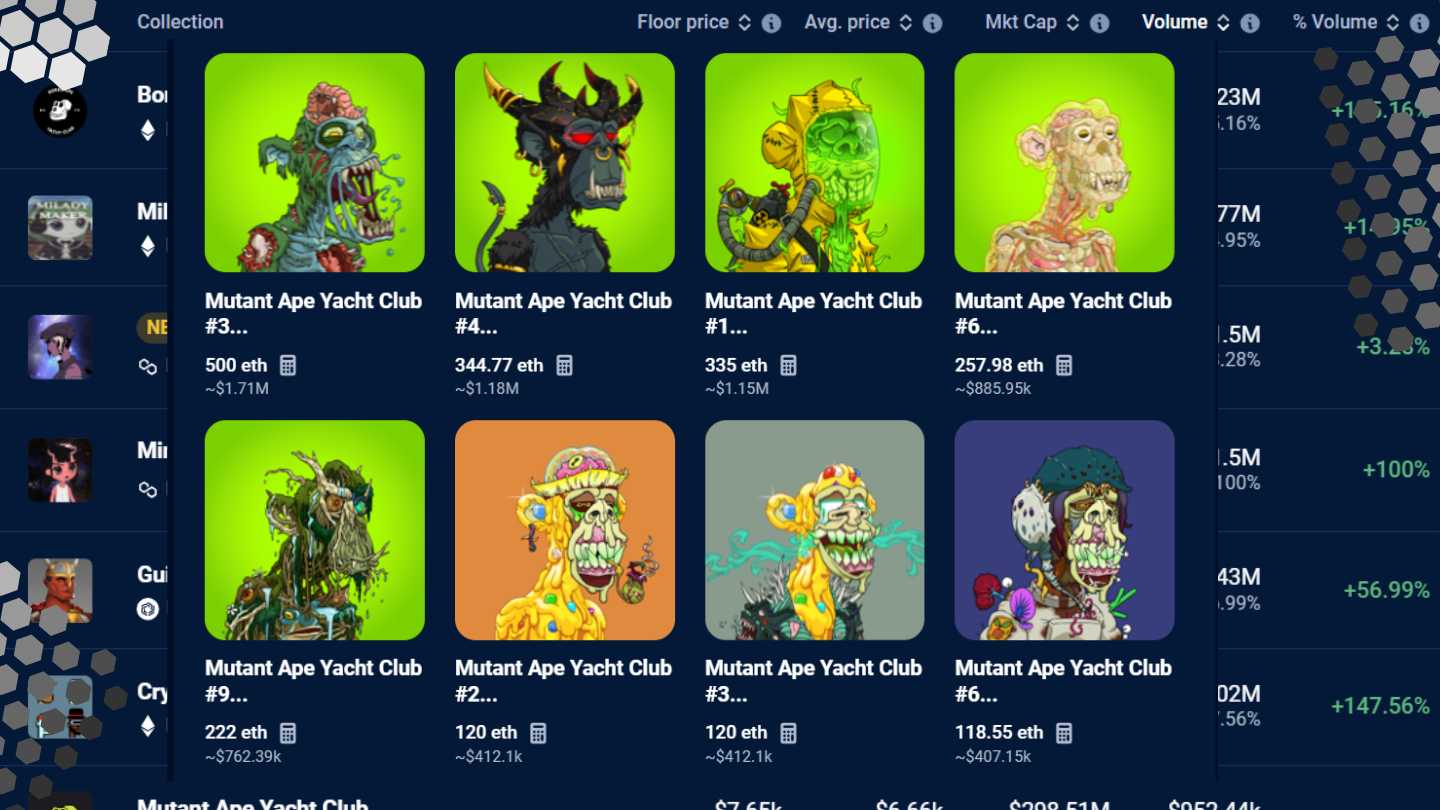

The MAYC collection was officially launched to the public on August 28, 2021, as a part of a “Mutant Serum” event that allowed BAYC NFT holders to create mutant versions of their ape NFTs.

Prior to the release of MAYC, BAYC had a market capitalization of approximately $660 million, and the ecosystem consisted solely of BAYC owners and Yuga Labs which was owned by the four founders.

At the time of the MAYC launch, there was uncertainty regarding the ability of Yuga Labs to sell all 10k MAYC NFTs and fears that the sale of a new collection (MAYC) would dilute value away from BAYC leading to a decrease in BAYC NFT prices due to increased competition.

A total of 20k MAYC NFTs were created, with 10k sold ($10,000 each) to the public and 10k given to BAYC Holders. This means that Yuga Labs and BAYC each received 50% of the earnings from the issue of MAYC. Unlike other NFT collections that offer no additional financial returns other than the change in price, BAYC Holders could claim future Yuga NFTs for free. The sale of MAYC proved to be a huge success for Yuga Labs.

The floor price as of mid June 2024 was $7,650.

ApeCoin ($APE) and ApeCoin DAO, March 2022

ApeCoin was launched on March 17 2022, as a utility token for the APE ecosystem, including BAYC, MAYC and other related projects. 1 billion ApeCoin tokens were issued. The token allocation was 47% of tokens to the APE ecosystem, 15% to Yuga Labs, 1% to charity, 8% to Founders, 14% to VCs, and 15% to BAYC & MAYC holders.

This allocation of ApeCoin favoured Yuga Labs stakeholders (71%) over BAYC and MAYC holders (29%) (Vader Research). The tokens assigned to BAYC and MAYC holders were immediately accessible, while those assigned to Yuga Labs, VCs, and Founders have a 4-year vesting period.

Many questions surround the economic motives of the 71-29 split and 4-year vesting period, with Mete Gultekin(Vader Research). expressing an alternative preference for a more equal 50-50 split where all allotted tokens are claimed gradually over a four-year vesting period.

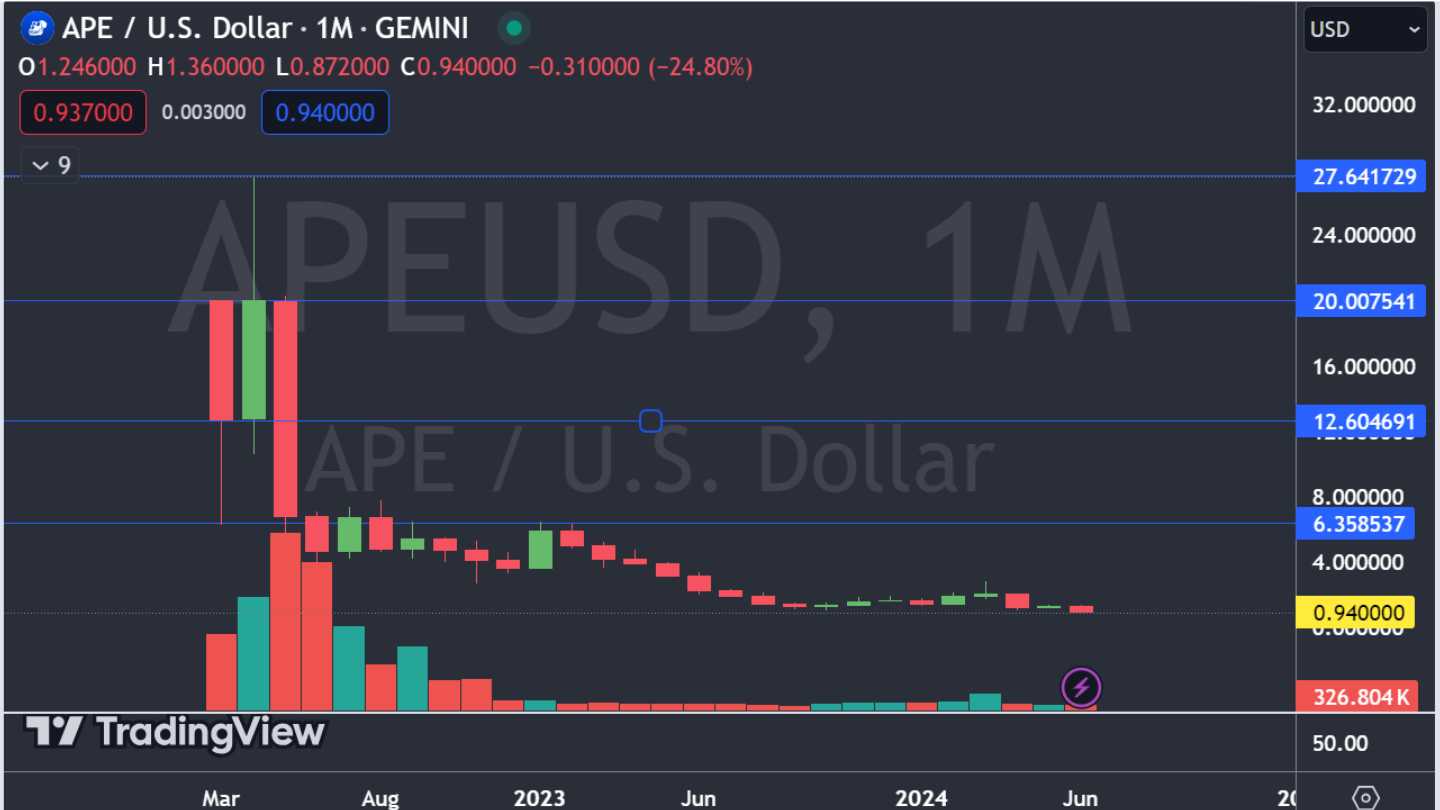

Here is a trading view (Gemini Exchange) of ApeCoin’s ($APE) prices since launch on the Gemini exchange. The initial volatility in the first 3 months was high and then prices settled around June 2022 at around $6.50, with a downward trend in 2023, currently trading around $0.94.

Ape Foundation

The APE Foundation, based in the Cayman Islands, was established by Yuga Labs, Inc. on February 8, 2022. It was created as a holding company to manage the intellectual property and other assets related to the Bored Ape Yacht Club and other Yuga Labs projects. The APE Foundation is not an active entity in terms of governance. The Ape DAO was established to take over governance functions. Ape DAO proposal archives show that the Ape Foundation was instrumental in designing the structure and process of Ape DAO. The APE Foundation is also responsible for project management and operations implementing the proposals voted on by the Ape DAO. It uses APE DAO treasury funds as directed through APE DAO governance and is responsible for fulfilling Ape DAO’s decisions (Gemini.com).

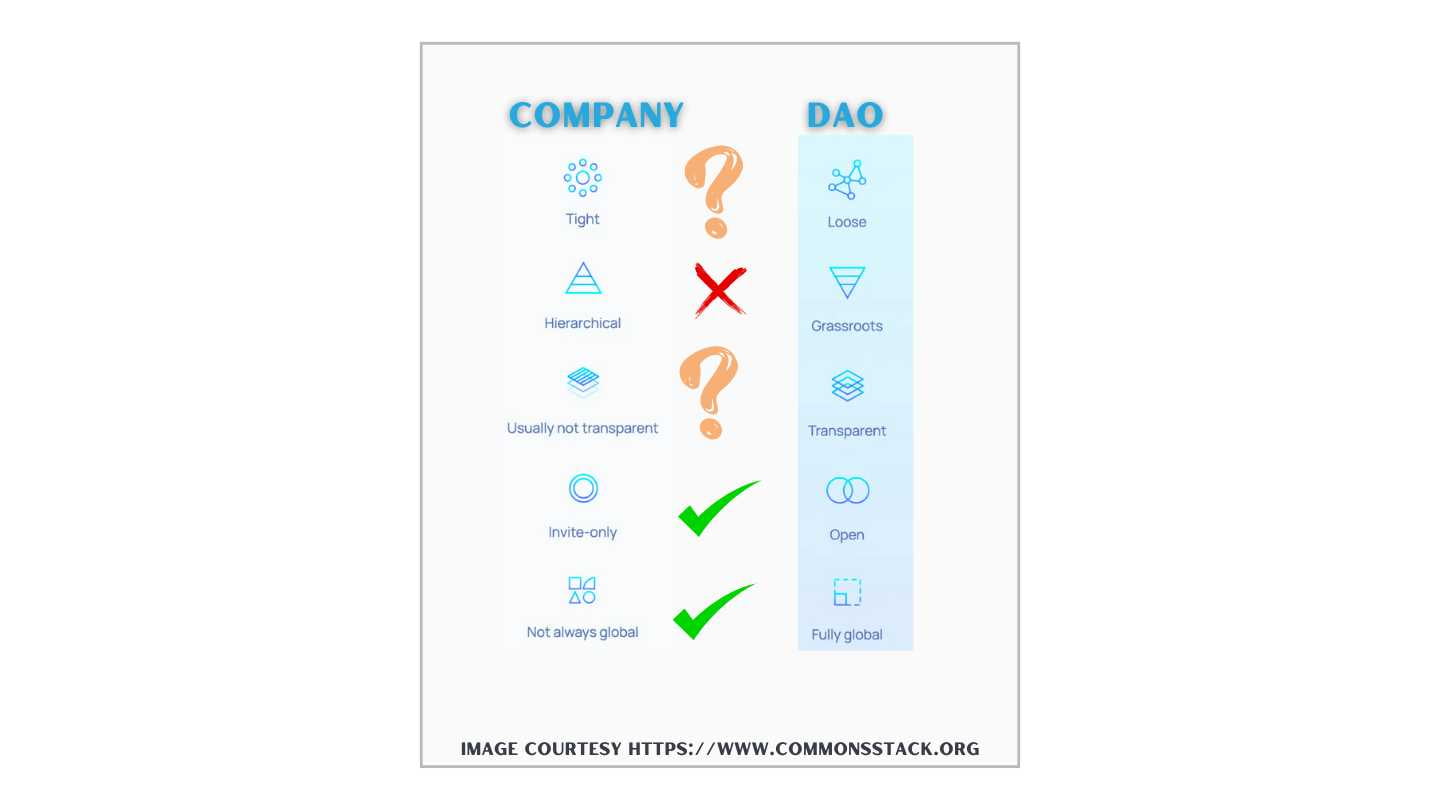

ApeCoin DAO (Decentralised Autonomous Organisation)

Yuga Labs officially announced the formation of the Ape DAO on March 29 2022. The Ape DAO (with the APE DAO treasury) is a decentralized autonomous organization (DAO) created to govern the Bored Ape Yacht Club (BAYC) and other Yuga Labs Ape Ecosystem projects, allowing holders to have a say in the future of the ecosystem. The DAO is built on the Ethereum blockchain and is powered by the $APE token.

The Multiple Stakeholder Problem

One of the biggest challenges that arise when dealing with multiple stakeholders is MISALIGNMENT OF INTERESTS. Due to the absence of legal or predetermined smart contract decisions regarding who is entitled to what, each stakeholder may strive to maximize their short-term earnings. At some point, there will likely be an internal conflict between multiple stakeholders as each one lobbies to accrue value to their assets.

To prevent this, Yuga Labs must be responsible for managing multiple stakeholders in a relatively fair manner when structuring new issuances and creating new earning channels. A well-designed structure should aim to minimize misalignment of interests and maximize collaboration across all stakeholders.

Vader Research, Value Accrual Case Study: Yuga Labs, Mar 8, 2023

Otherdeeds (Otherside Metaverse), Launch May 2022

Otherdeeds was launched as a part of the “Otherside” Metaverse project, which is a collaboration between Yuga Labs and Animoca Brands.

In the days leading up to the Otherdeeds sale, Bored Ape Yacht Club (BAYC), Mutant Ape Yacht Club (MAYC), and ApeCoin were all trading at their all-time highs. BAYC had a $4 billion market cap, MAYC had reached $2 billion, and $APECoin had a market cap of $6.5 billion.

Of the 100k Otherdeeds issued, 55k NFTs were sold publicly (by Yuga Labs), 10k were given to BAYC, 20k were given to MAYC, and 15k were reserved by Yuga Labs. In total, 70% of the Otherdeeds were allocated to Yuga Labs.

We are seeing another case where Yuga Labs got overallocated at the expense of NFT stakeholders & $APE token holders. Additionally, MAYC Holders got overallocated at the expense of BAYC Holders and ApeCoin holders didn’t get any Otherdeeds allocation.

Vader Research, Value Accrual Case Study: Yuga Labs, Mar 8, 2023

The 55k Otherdeed NFTs were sold publicly by Yuga Labs for $310M. The primary sale occurred using $APE. Each of the 55 000 unique NFTs sold almost immediately (the cost to mint an Otherdeed NFT was 305 $APE). Yuga Labs pledged not to touch the $APE proceeds from the primary sale for 1 year. (The value of these $APE proceeds was worth roughly $80M 1 year later in March 2023).

Value can only accrue to $APE permanently if $APE is deposited into $APE DAO’s treasury wallet. In this way the $APE held in the treasury would be subject to collective voting by the APE governance on how to utilize it, as it would remain on APE DAO’s balance sheet.

Otherdeeds average floor price fell from $31k to $2k in 7 months from launch and generated $56M in Otherdeeds royalties from secondary sales.

The Challenge of Dilution in the Yuga Ecosystem

The creation and sale of new NFT collections, such as MAYC and Otherdeeds, represent a significant source of revenue for the Yuga Ecosystem. Yuga Labs earned $100m from MAYC and $330m from Otherdeeds primary sales, while holding $2bn+ worth of Ape Coin and $40m worth of Otherdeeds on its balance sheet.

However, releasing new NFT collections has a downside: it dilutes the ownership of existing Yuga Ecosystem stakeholders (BAYC, MAYC, ApeCoin, Otherdeeds etc.). For existing stakeholders in the Yuga Ecosystem to benefit from dilution, the value created from issuing and selling a new NFT collection should outweigh the dilution costs.

The idea is akin to the concept of mergers and acquisitions (M&As), where the purchasing firm acquires the target company through an exchange of shares. As a result, the shareholders of the purchasing company experience dilution. The success of the acquisition hinges on whether the value created by the target company outweighs the cost of the dilution. If the value generated is greater, the acquisition is deemed successful; otherwise, it is considered a failure.

Vader Research, Value Accrual Case Study: Yuga Labs, Mar 8, 2023

SewerPass (Gaming), Launch January 2023

At the start of 2023, the value of Yuga had declined together with the downward trend of the cryptocurrency market. The Yuga Ecosystem’s value fell from $17 billion in May 2022 to $3.8 billion in January 2023.

The release of SewerPass NFTs was accompanied by the launch of the game Dookey Dash to which the SewerPass gives access.

A total of 21,791 SewerPasses were issued. Yuga Labs opted to reward all the SewerPasses to BAYC and MAYC holders, excluding themselves from this issue. ApeCoin holders and OtherDeeds holders were also excluded.

Dookey Dash in-game microtransactions are purchased using $APE currency, and the proceeds from these transactions are deposited directly into the $APE DAO’s Treasury (these microtransactions are relatively insignificant when compared to the value of the SewerPass).

Dookey Dash players with the highest scores are eligible to earn new NFTs created by Yuga Labs. Yuga Labs innovated on the usual airdrop of NFT rewards, by airdropping ENTRY PASS NFTs that could reward players with new NFTs based on their gameplay skill. This enables Yuga NFT holders (BAYC, MAYC, BAKC) to sell their ENTRY PASS NFTs to speculators gambling on high future prices of new NFTs (rewards) and their competence levels of gameplay skills. Yuga has the flexibility to decide on the value of the total NFT rewards (SewerPass NFT Floor Price late January 2023 was trading at $3k equating to a Sewer Pass Market Cap of $65m).

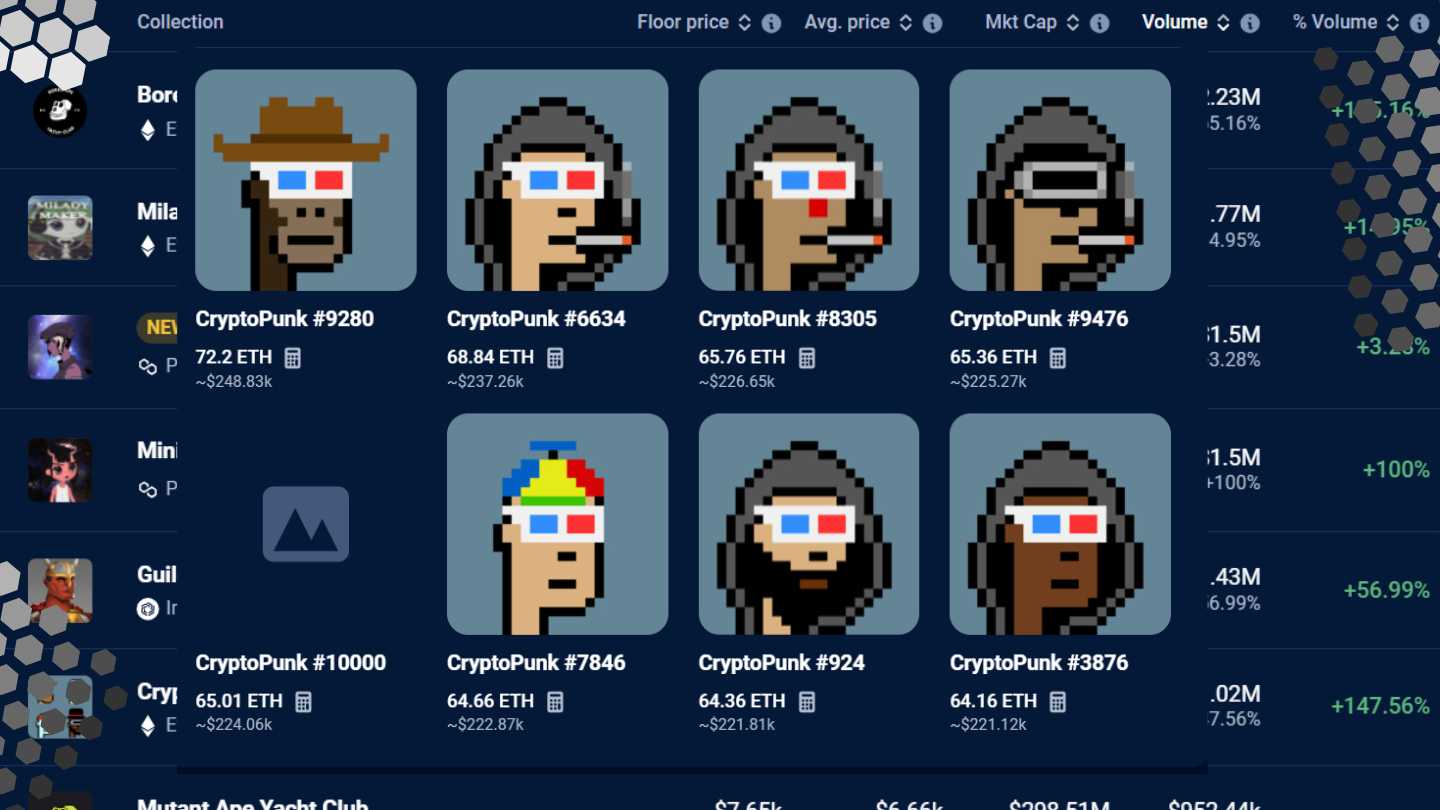

CryptoPunks Acquisition from Larva Labs, 11 March 2022

CryptoPunks, which now can sell for as much as two hundred thousand dollars apiece, weren’t originally the basis for a social avatar club, but some collectors (including Jay-Z) use them as avatars—flaunting one as your profile pic, or “P.F.P.,” was the ultimate symbol of digital cachet. “It’s like having a Harvard degree in the N.F.T. space,”

Conversation with BAYC founders, New Yorker, Kyle Chayka, July 30, 2021

Yuga Labs acquired the intellectual property rights and copyright (IP) of CryptoPunks (423) and Meebits (1711) from Larva Labs on 11 March 2022. By acquiring CryptoPunks and Meebits, Yuga Labs expanded their portfolio of NFT collections, solidifying their position as a major player in the NFT space.

CryptoPunks is widely believed to be the most iconic and influential profile picture (PFP) collection in the NFT world. The floor price for a CryptoPunk mid June 2024 around $90,360. Larva Labs faced controversy over their handling of the CryptoPunks project regarding commercialization rights for the NFTs as well as taking a litigious approach to derivative NFT projects.

The Super Punk World Collection, May 2024

The Super Punk World collection is a 500-piece digital avatar collection created by Nina Chanel Abney as part of the Punk in Residence program by CryptoPunks. This collection combines the iconic CryptoPunks traits with attributes from Abney’s first NFT collection, Super Cool World. The collection features hybridized 3D sculptures that explore themes such as race and gender.

Yuga Labs gave full commercial rights to CryptoPunks and Meebits owners. This allows creators and community developers to incorporate these NFTs into their digital and physical projects worldwide. Yuga Labs goal was to seed a vibrant new community around CryptoPunks and Meebits, encouraging creators and third-party developers to build derivative works and projects featuring these NFTs.

In May 2024, just after the release, Yuga Labs announced the suspension of the release of the new Super Punk World collection due to a wave of criticism from the CryptoPunk community. The new collection is made up of 500 hybrid 3D sculptures. The essence of the criticism seems to centre around the perception of the new art as “woke” and “politically correct” and therefore according to these critics, not in alignment with the values of the original CryptoPunks.

The Yuga Ecosystem is made up of two different stakeholder communities, the APE Ecosystem and the CryptoPunk Ecosystem. The APE holder community – hyper-masculine, Hemingwayesque type crypto-bros are certainly not aligned with the LGTBQ, woke, politically correct community and art aesthetic of Super Punk World. What they do share in common is being early crypto adopters and resonating with the NFTs spirit of irreverent playfulness.

The release of the Super Punk World collection was clearly not managed well. The sudden announcement of the suspension of the collection, a knee-jerk response to unexpected kick-back. Both the criticism from the CryptoPunks community and the clumsy management by Yuga Labs is not a good look and must have left a very bad taste for Nina Chanel Abney and her supporters.

Yuga Labs later communicated that they plan to “get Abney’s collection to her community”, clearly distancing themselves from the collection. The Yuga Labs CEO further said on X.com they would “no longer touch CryptoPunks”. Does this throw a spanner in the works for those already “build(ing) derivative works and projects featuring these NFTs“?

The Super Punk World Collection wobble is a classic example of the multiple stakeholder problem, and how if it is not managed well, can manifest in discontent and even mutiny (threats of selling and leaving the community). Something that has not been covered in this article, is the dilution effect for the Ape Ecosystem NFT stakeholders from Yuga Labs’ purchase of the CryptoPunks. It could also be said that The Super Punk World Collection has a dilution effect for the CryptoPunk stakeholders which may have been an unarticulated concern around the negative response of the Super Punk World Collection release.

The Yuga Labs Value Accrual Business Model: Observations, Questions & Conclusions

Challenges of the Value Accrual Model

The biggest challenges for Yuga’s value accrual business model is (1) achieve sustainable revenue (2) provide value to the Yuga community (stakeholders) (3) respond to legal and regulatory challenges.

Sustainable Revenue

Yuga’s primary revenue channels are the issuing of new NFT collections and $APE tokens. NFT royalties, while substantial for the Yuga Ecosystem, are very much a secondary revenue channel and by no means a sustainable revenue.

The issuing of new NFT collections presents the challenge of dilution. Solving the problem of dilution requires a well-structured value accrual model, a solid grasp on the multiple stakeholder problem and therefore clear insight into the diverse interests, fears and motivations of the different stakeholders.

Providing Value to the Yuga Ecosystem Community

There is a compelling value proposition for buying BAYC and MAYC. By owning these assets, holders receive a percentage of every new Yuga NFT or ApeCoin issued. Even though Yuga may sometimes allocate fewer rewards to BAYC and MAYC stakeholders, they still receive a certain percentage.

The value proposition for APECoin ($APE) is less clear:

$APE can be used by $APE holders to participate in governance proposals and voting within the Ape DAO. Users can purchase and trade NFT assets related to the Otherside Metaverse on external marketplaces such as OpenSea using $APE as the primary currency for these transactions. The Otherside Metaverse has faced some challenges, including technical issues, community concerns, and criticisms regarding its governance and transparency.

Yuga Labs has mentioned plans for a marketplace within the Otherside Metaverse where users can buy, sell, and trade NFT assets. When this marketplace becomes operational, it is expected that transactions will be executed with $APE, as it is the native token of the Ape DAO and the Otherside Metaverse.

Sewer Passes can be sold on secondary markets like OpenSea, and these sales executed using $APE as the primary currency. Sewer Pass holders can stake their passes on the SewerPass platform earning rewards in the form of $APE tokens.

ApeCoin facilitates a range of “utilities”, like access to and voting rights to ApeCoin DAO and a medium of exchange, but it is not clear how Yuga ecosystem earnings can accrue to ApeCoin ($APE). This is possibly reflected in ApeCoin’s price dropping off an all time high of $27.64 (Apr 2022 / Gemini) to $6.50 June 2022 and trading around it’s all time low $0.94 June 2024.

Legal and Regulatory Challenges

“$APE is trading on Coinbase and a bunch of other exchanges. (…) Unlike a company selling its shares, the ApeCoin DAO — the decentralized autonomous organization supposedly behind it all — isn’t registered with the SEC. Technically, this DAO isn’t really a legally-recognized entity at all. ApeCoin seems like an attempt to remain in a legal gray area.”

Elizabeth Lopato, The Verge, 25 March 2022

ApeCoin DAO serves to manage the Yuga ecosystem’s multiple stakeholder challenge by ring-fencing the ApeCoin ecosystem’s stakeholder community and empowering them to make decisions on matters that effect the value of the NFTs and $APE they hold.

Once ApeCoin was issued and trading on exchanges, Yuga Labs had to strategically remove itself from the operations of ApeCoin DAO for legal reasons. This decision allows the company to separate its involvement from the token’s governance and management, ensuring compliance with regulatory requirements.

However, in the Ape DAO, each voter has one vote, but the weight of that vote is proportional to the number of $APE tokens they hold. This means that stakeholders with the largest number of $APE tokens have more voting power than those with fewer tokens. A significant portion of the $APE tokens and thus voting power is held by Yuga Labs. Difficult to reconcile legal and regulatory imperatives for Yuga Labs to strategically distance from ApeCoin DAO with their overwhelming weight of voting power in ApeCoin DAO.

Hybrid Company-DAO Organisation Structure

The way Yuga Labs uses ApeCoin DAO is antithetical to the grassroots democratic and decentralised ethos of the DAO. If the top 10 voters hold the majority of the voting power, why would others participate in the DAO and vote?

Was it the right approach launching ApeCoin as a value proposition in itself, when essentially it is a vehicle to enable deeper opportunities and utilities like in-game and in-world exchange and transacting for Yuga’s bread and butter NFT business?

Can Yuga’s success inform start-ups in other parts of the globe?

The profile picture (PFP) collectibles NFT market, inspired by Yuga’s success, mushroomed exponentially, became saturated and has pretty much lost its general appeal.

Hyper-masculine, Hemingwayesque type Crypto-bro’s

Yuga Labs hit the sweet spot in the targeting of this sub-culture with their BAYC collection – as well as the timing of the BAYC launch, perfectly catching the bull trend wave in the cryptocurrency and NFT markets in April 2021.

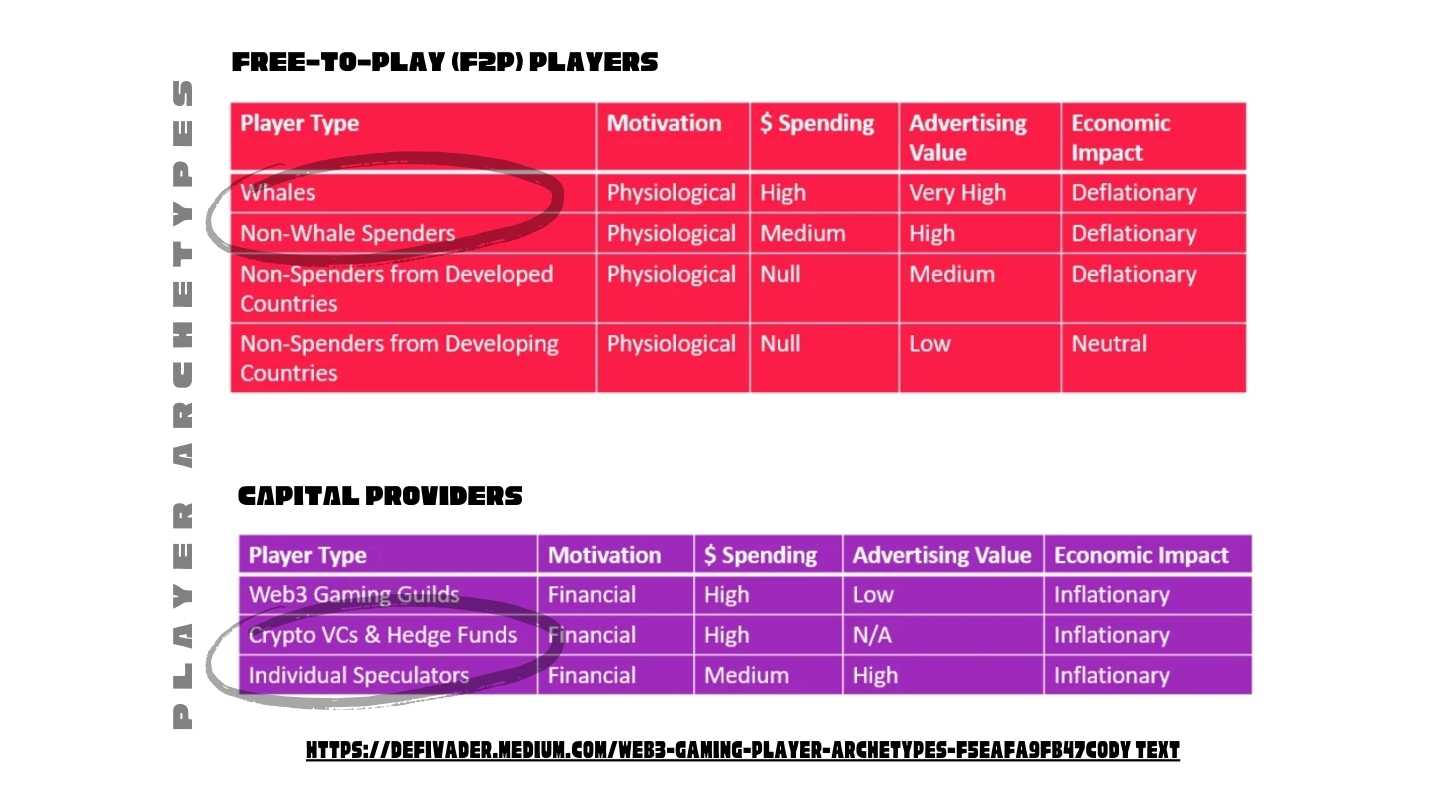

This diagram of Web3 Player Archetypes (Vader Research) is useful here. The BAYC sub-culture is positioned in the Whales and Non-Whale Spenders (Red Zone) as well as the Crypto VCs and Individual Speculators (Purple Zone). These are the top USD spenders. There is also a good mix between physiological (feel-good identity fit) motivation and financial motivation.

The Web3 Value Accrual Business Model

Yuga’s success can and has inspired many start-ups globally. Yuga’s perfect targeting of hyper-masculine, Hemingwayesque type Crypto-bros (high value, digital and crypto savvy USD spenders) is key to their success. There is a good fit between the value accrual business model, web3 and Digital Art because it allows a business to scale. I believe this combination is a powerful tool for business-led socio-economic revival (innovation) which can serve a redistribution of wealth function for the Global South (developing countries). This is a subject for a separate article.