Digital art licensing offers creators the opportunity to strategically monetize their work while reaching different audiences through NFTs. By understanding the nuances of personal use, commercial use, and Intellectual Property (IP) rights licenses, artists can unlock new revenue streams, engage with a broader range of collectors and position themselves for long-term success. These licensing options not only influence the accessibility and value of digital artworks but also open up possibilities for collaborations, brand expansion, and new business models. As the NFT space continues to evolve, learning to navigate these licensing pathways becomes crucial for digital artists looking to thrive in the market.

Licensing Options for Digital Artists

Licensing options offer digital artists flexible revenue models and broader audience reach. Personal use licenses spawn collectors and investors – while commercial and IP licenses offer opportunities for higher prices and business collaborations.

Personal Use Licensing

This licensing option allows the buyer to use the digital artwork for personal enjoyment, such as displaying it on digital devices or making a limited number of prints.

Personal use licenses make digital art more accessible to casual collectors who want to enjoy the artwork at home. It allows artists to reach a broader audience without giving away significant commercial rights. NFTs with personal use licenses can still be resold on secondary markets, providing artists with royalty income from each resale. Artists retain control over the artwork’s usage and distribution. This can help maintain the exclusivity and value of the original work.

Since personal use licenses restrict how the artwork can be used, they typically command lower prices than commercial or IP licenses. There is still always a risk that buyers misuse the artwork by making unauthorized reproductions or using it for commercial use without the artist’s consent. Commercial use and IP use licenses make it easier to resell the artwork at a higher price.

Commercial Use Licensing

This license allows buyers to use the artwork for commercial purposes, such as displaying it in a business, reselling prints, or using it in marketing.

Artists can charge more for commercial licenses since the buyer is using the artwork for profit-generating purposes. Commercial use can lead to broader visibility as businesses incorporate the artwork into their marketing or products, potentially raising the artist’s profile. Artists can establish ongoing licensing agreements with commercial users, providing a steady revenue stream.

Once a commercial license is granted, the artist may have little control over how the artwork is used, potentially affecting the artist’s brand and reputation if contexts are undesirable. Allowing multiple commercial licenses could lead to overexposure, diluting the artwork’s perceived uniqueness and value. Enforcing the terms of a commercial use license, such as monitoring unauthorized sublicensing, can be challenging and may require legal intervention to remedy the misuse or abuse.

IP Rights Licensing

This option grants the buyer full intellectual property rights, allowing them to reproduce, modify and distribute the artwork freely. Since the buyer acquires full IP rights, artists can charge a premium for this type of license. IP licensing can lead to partnerships, where buyers create derivative works or merchandise, potentially earning artists a share of future revenues. Selling IP rights can be a way for artists to capitalize on their digital assets fully, especially if they plan to move on to new projects.

Once IP rights are sold, the artist loses full ownership and can no longer control how the artwork is used, modified, or distributed. If the buyer creates low-quality derivative works or floods the market with merchandise, it could diminish the reputation and value of the original piece. Full IP transfers involve more intricate legal considerations, such as moral rights, which may still persist even after selling the IP, depending on local laws.

Trends in Successful NFT Marketplaces

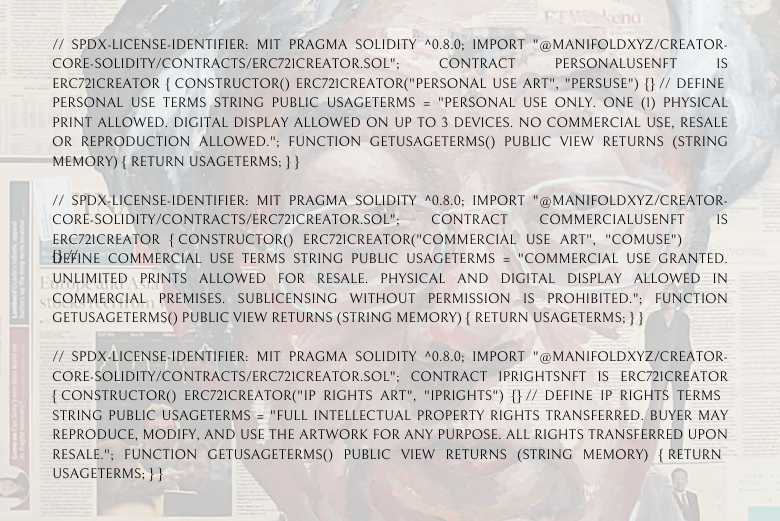

Manifold.xyz is known for enabling artists to deploy fully customised smart contracts, giving creators complete control over the contract’s code and its terms. This is popular with artists who want to ensure their NFTs reflect unique rights or functionalities.

While SuperRare primarily focuses on high-end digital art and curates its platform, it still allows artists to set royalty percentages. The platform manages other aspects to maintain quality and uniformity.

Foundation provides options for artists to deploy contracts that enable dynamic behaviours, such as programmable art, where the state of the NFT can change based on external data feeds.

OpenSea uses shared contracts for ease of use but allows lazy minting, where NFTs are created only upon purchase. For more advanced use cases, creators can deploy their own smart contracts and list them on OpenSea.

Customising Licensing Contracts on NFT Marketplaces

While the leading NFT marketplaces offer basic functionality and ease of use for minting, the trend toward customization is growing. Platforms like Manifold, Zora, and Foundation cater to users who want more control over their smart contracts. The level of customization should be chosen based on the artist’s needs, technical ability and the intended use of the NFTs. For artists aiming to create unique licensing terms, custom smart contracts can be a powerful tool – but they come with challenges related to cost, complexity, and security.

Royalties

One of the most common customizable aspects is the ability to set royalties on secondary sales. Most platforms support this, with artists able to specify a percentage (e.g., 5-15%) that gets paid to them each time the NFT is resold.

Access Control

Some marketplaces allow custom smart contracts to manage access, such as unlockable content, which can include high-resolution files, exclusive perks, or private access links.

Metadata and Storage Options

Advanced contracts let users choose between on-chain (stored directly on the blockchain) or off-chain (stored on IPFS or another decentralized service) metadata storage.

Custom contracts can even incorporate features like dynamic metadata that changes based on external conditions. Dynamic metadata in NFT smart contracts refers to metadata that can change over time or in response to external conditions, making the NFT’s properties or appearance evolve based on specific triggers or events. An NFT might change based on how the owner interacts with it. For example, if the owner participates in certain events, holds other specific NFTs, or performs specific actions (like staking the NFT in a decentralized finance platform), the metadata could update to reflect these activities. This might unlock new visuals, animations, or benefits within the NFT.

Edition Type and Distribution Mechanism

Artists may include details of the edition type, like open editions or limited editions, as well as distribution mechanism like airdrops or auction-based sales, when these details impact the licensing terms. For example, a limited edition might include extra licensing rights like limited commercial use as a premium feature, while open editions might only offer personal use rights.

Platforms like Foundation or Async Art support programmable artwork, where elements of the NFT can change over time or be modified by the owner.

Licensing Terms and Legal Clauses

While most standard contracts do not explicitly cover licensing, custom contracts can include legal terms about usage rights (e.g., personal, commercial, or IP rights), making them enforceable via blockchain transactions.

Challenges with Custom Smart Contracts

Technical Complexity

Customizing smart contracts requires technical skills in Solidity, the programming language for Ethereum smart contracts, which can be a barrier for artists without coding knowledge.

Higher Gas Fees

Deploying a custom contract on Ethereum can be costly due to gas fees. When you create a custom smart contract, it first needs to be deployed to the Ethereum blockchain. This deployment process registers the contract’s code and functionality on the network, making it accessible for future transactions. This transaction incurs gas fees. The more complex the contract (e.g., with many functions or a large amount of code), the higher the gas fees can be. The deployment of the custom contract is a one-time cost, but it must be paid before any NFTs can be minted or sold using that contract.

Some platforms support layer-2 solutions or alternative blockchains (e.g., Polygon, Tezos) to reduce costs. OpenSea supports Polygon as a layer-2 solution for minting and trading NFTs. You can deploy your own custom smart contract (using Remix, Truffle, or Hardhat) such as an ERC-721 or ERC-1155 on the Polygon network. The smart contract on the Polygon blockchain is compatible with Ethereum’s standards but with significantly lower gas fees. Once the custom contract is deployed on Polygon, you can integrate it with OpenSea. OpenSea allows users to list, buy, and sell NFTs minted under custom contracts deployed on Polygon just like they do with Ethereum-based NFTs. While OpenSea supports Polygon, the volume of activity on Polygon is generally lower than on Ethereum, which might affect visibility and liquidity.

Similarly, Hic et Nunc (now operated through various community-driven projects like Teia.art) uses Tezos as its underlying blockchain for NFT transactions. Tezos is an alternative to Ethereum and offers much lower gas fees due to its proof-of-stake consensus algorithm.

Immutable X is a layer-2 scaling solution for Ethereum specifically focused on NFTs and gaming assets. Platforms like Gods Unchained (a digital trading card game) and Rarible offer support for Immutable X, allowing users to mint and trade NFTs without paying gas fees.

Some marketplaces may charge extra fees for custom contracts. While OpenSea allows artists to use its shared storefront contract without deployment fees, deploying a custom smart contract (such as for a fully customizable ERC-721 or ERC-1155 contract) requires paying gas fees for contract deployment on Ethereum. Additionally, if the custom contract has features beyond standard functionalities, there could be extra charges associated with integrating it into OpenSea’s platform. Gas fees for deploying custom contracts on Ethereum can be quite high and OpenSea may also take a 2.5% commission on sales.

Security Risks

Custom contracts introduce potential security vulnerabilities if not properly audited, which can lead to issues like exploitation or loss of funds. To mitigate these risks, use trusted templates as a starting point. Start with well-audited, open-source smart contract templates like Manifold’s contract templates.

If adding licensing terms, make sure they are written in plain language and legally sound, possibly verified by a legal specialist.

Using Digital Art Licensing Strategically

Digital artists have leveraged IP and commercial rights strategically to enhance their success in the NFT space. By granting these rights instead of just offering personal use licenses, they have opened up broader opportunities for monetization, partnerships, and brand expansion.

Granting commercial rights transforms collectors from passive holders into active participants who can capitalize on the value of the artwork. This community-driven approach has been crucial for projects like BAYC and World of Women.

Artists like Beeple and projects like CryptoKitties have shown how retaining certain rights can lead to significant partnerships, exhibitions and gaming integrations.

When artists or projects include dynamic elements, such as the ability to modify, breed, or license NFTs, the perceived and actual value of these digital assets increases.

Beeple (Mike Winkelmann)

Beeple’s success has largely been tied to the way he handled IP rights for some of his pieces. While not all of his NFTs come with commercial or IP rights, certain works were sold with rights that allowed collectors to explore additional uses beyond personal display.

Beeple’s “Everydays: The First 5000 Days,” which sold for $69 million, didn’t explicitly include full IP rights, but the sale significantly increased the value of his brand and opened doors for commercial collaborations with brands like Louis Vuitton. His reputation grew, leading to lucrative opportunities that leveraged his style and creations in commercial projects.

By carefully considering when to retain IP rights and when to grant commercial use, Beeple was able to maintain control over his brand while still exploring commercial avenues, including exhibitions, merchandise and corporate partnerships.

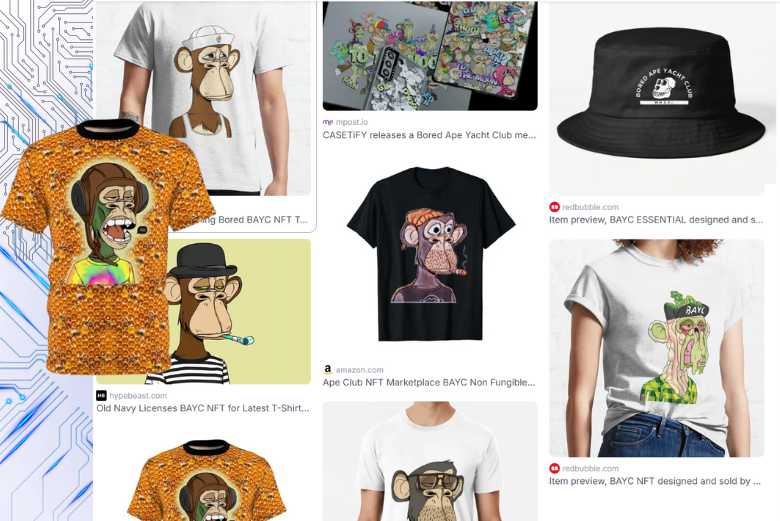

Bored Ape Yacht Club (BAYC)

One of the key factors behind the success of BAYC was granting commercial rights to the NFT holders. This meant that buyers were not just purchasing an NFT; they also acquired the right to use the character commercially, such as in merchandise, brand collaborations, and even creating derivative works.

Holders have used their BAYC NFTs for various commercial purposes, including launching clothing lines, creating beer brands, and even licensing the characters for music videos and TV shows.

By empowering collectors with commercial rights, BAYC turned its NFT holders into brand ambassadors, fostering a sense of ownership and community while expanding the brand’s reach across multiple industries.

World of Women (WoW)

World of Women is another NFT project that offers owners commercial rights to the NFTs they hold. By allowing collectors to use their WoW NFTs for commercial purposes, the project has fostered collaborations with brands and fashion companies.

Some holders have entered into licensing agreements with third parties, enabling their NFTs to appear in brand campaigns and products.

The ability for collectors to monetize their NFTs has not only added value to the WoW brand but also increased individual holder engagement, with some collectors actively seeking business opportunities for their NFTs.

CryptoKitties

CryptoKitties, one of the first successful blockchain-based games, allowed users to breed digital cats to create new NFTs. The IP rights of individual kitties could be leveraged by the owner for specific uses within the game’s ecosystem or even for merchandising.

The commercial use of the NFTs enabled players to generate revenue by breeding rare cats, creating a marketplace for both the digital cats and the genetics behind them.

By integrating commercial aspects directly into the game mechanics, CryptoKitties not only popularized digital collectibles but also introduced a business model where digital asset ownership could extend to monetizable activities.

Pak’s Merge and Lost Poets

Pak has explored various licensing models, including full and partial IP transfers. With projects like “Merge,” collectors could potentially use the NFTs in their own creative endeavours, while “Lost Poets” involved dynamic, evolving NFTs that offered commercial potential depending on the collector’s strategy.

Pak’s strategy involves engaging collectors in a participatory experience, where the possibility of future commercialization adds a layer of value. By creating works with built-in flexibility around usage rights, collectors feel they are part of the ongoing creative journey.

This approach encourages collectors to think of NFTs not just as art but as assets with future utility, making IP rights a central part of the project’s appeal.

Closing

The diverse licensing options available in the digital art and NFT space present both opportunities and challenges for artists. By strategically choosing between personal use, commercial use and IP rights licenses, artists can enhance the value of their work, reach new markets, and create more dynamic engagement with their collectors. However, careful consideration of the potential downsides, such as loss of control over the artwork’s use or market saturation, is essential for maintaining the integrity and long-term value of the original piece. As digital art licensing continues to evolve, artists who master these licensing strategies will be well-positioned to maximize their creative and financial potential.